Condo Insurance in and around Marquette

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

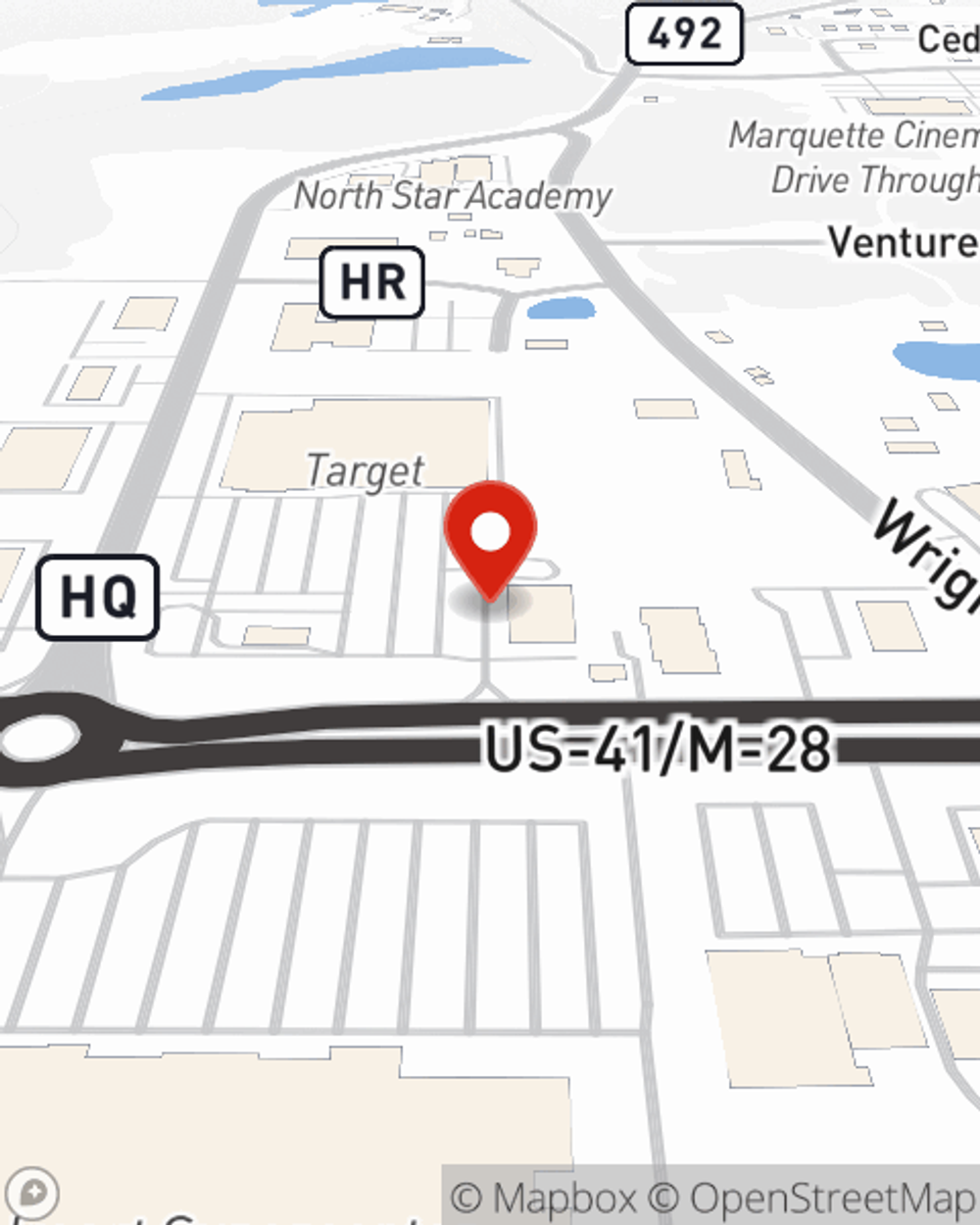

- Marquette

- Escanaba

- Ishpeming

- Negaunee

- Gwinn

- Rapid River

- Gladstone

- Republic

- Wilson

- Carney

- Cornell

- Champion

- Menominee

- Rumely

- Michagamme

- Green Bay

- Trenary

- Palmer

- Skandia

- Wetmore

- Harvey

- Big Bay

- Chatham

- Munising

Welcome Home, Condo Owners

Often, your haven is where you are most able to take it easy and enjoy family and friends. That's one reason why your condo means so much to you.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Why Condo Owners In Marquette Choose State Farm

We get it. That's why State Farm offers excellent Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Jill Leonard is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you need.

When your Marquette, MI, condominium is insured by State Farm, even if something bad does happen, State Farm can help cover your one of your most valuable assets! Call or go online today and find out how State Farm agent Jill Leonard can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Jill at (906) 273-2700 or visit our FAQ page.

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Jill Leonard

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.